Business Summary

Apple Inc. is an American international technology company headquartered in Cupertino, The golden state. Established in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple originally concentrated on computers. Over the years, it has expanded right into various customer electronic devices, software application, and on-line solutions.

Secret Products:

- iPhone

- iPad

- Mac computer systems

- Apple Watch

- Apple TV

- Operating systems: iphone, macOS, watchOS, tvOS

- Providers: App Store, Apple Songs, iCloud, Apple Pay, Apple Television+

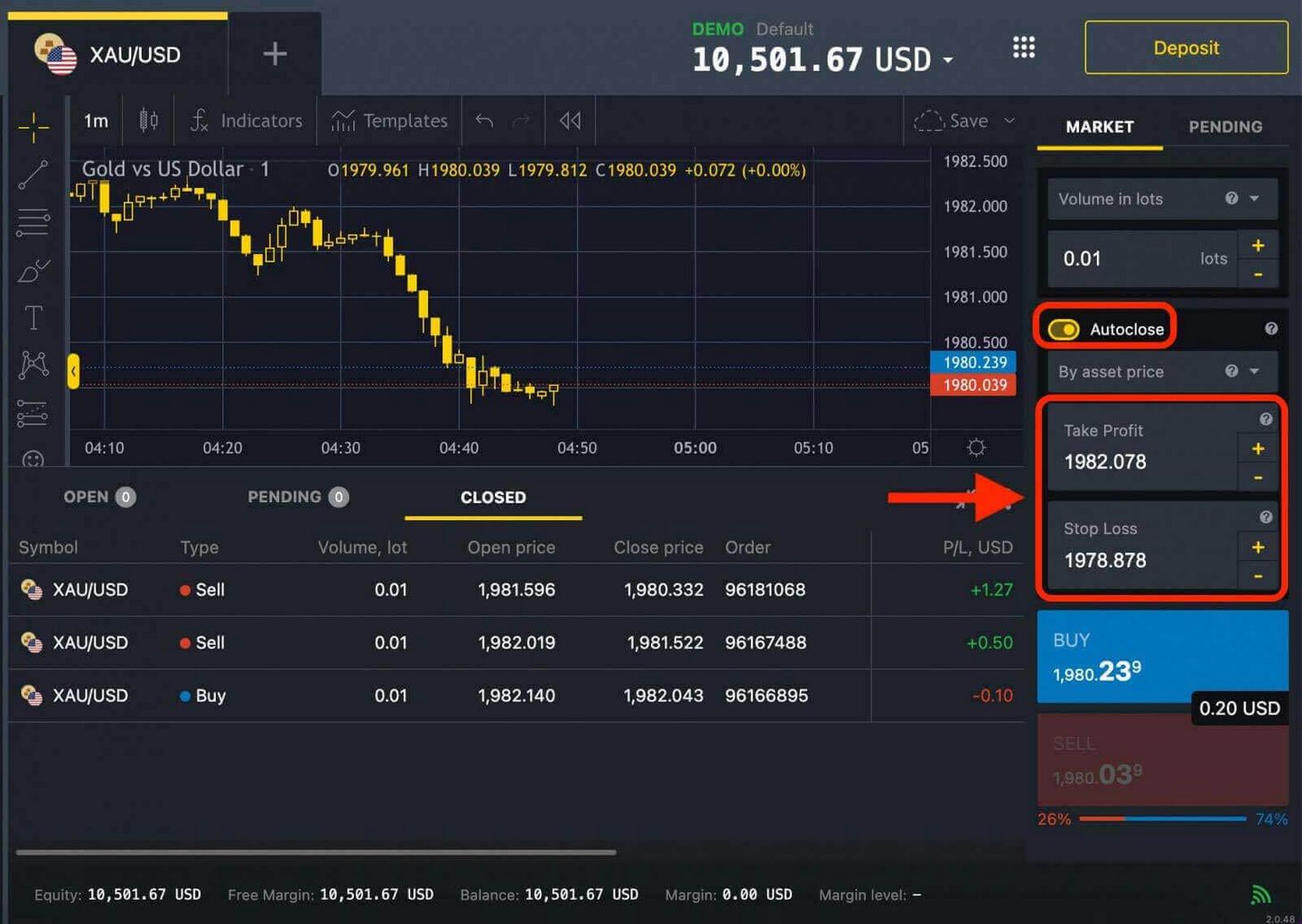

How to Acquire Apple Shares in India by means of Exness

Exness, a leading online trading platform, supplies Indian investors with the possibility to get Apple shares. Here’s a detailed guide:

-

Open an Exness account:

- See the Exness website and sign up for an account.

- Complete the Know Your Customer (KYC) procedure by sending the required records.

-

Down payment funds:

- Transfer the preferred investment amount into your Exness trading account.

- Offered payment techniques include bank transfer and UPI.

-

Select Apple shares:

- In the Exness trading platform, search for Apple shares (AAPL).

-

Put an order:

- Make a decision the variety of shares you wish to get.

- Establish the order type (market or limitation).

- Location the order.

-

Confirm acquisition:

- Evaluation the order details.

- Validate the acquisition.

- The shares will certainly be attributed to your trading account as soon as the order is carried out.

-

Display financial investment:

- Keep track of your investment through the Exness platform.

- Handle your portfolio accordingly.

read about it Exness in India from Our Articles

Market Circumstance

Apple operates in the extremely affordable customer electronic devices and innovation industry. Major competitors include Samsung, Google (Alphabet Inc.), Microsoft, and Amazon. In spite of intense competitors, Apple keeps a solid market placement, specifically in smart devices and individual computer.

- The apple iphone, presented in 2007, revolutionized the mobile phone market and continues to be one of the best-selling items globally.

- Apple’s strategy highlights premium products, layout high quality, and an incorporated ecosystem, cultivating brand commitment.

- The company’s solutions section, including the Application Shop, Apple Songs, and iCloud, contributes dramatically to its earnings.

Influencing Factors

Internal Elements:

- Technology and R&D Brand name loyalty

- Ecological community assimilation Exterior Elements: Market competitors Financial conditions Regulatory

- atmosphere Analyst

- Opinions John Doe, Senior Analyst at Tech Insights:

Apple s

solid community and technology pipe position it well for ongoing development. The business s focus on expanding its services offerings and wearables segment is likely to drive considerable profits growth in the coming years. However, the success of brand-new item groups like the Vision Pro headset will certainly be essential in preserving Apple s market prominence. Jane Smith, Market Strategist at Future Trends: While Apple encounters&

tough competition from other tech titans, its brand strength

and consumer commitment remain unrivaled in the market. The intro of the Vision Pro and improvements in increased reality could open up brand-new revenue streams and strengthen Apple s position as a pioneer. Nonetheless, the business should navigate possible governing obstacles and supply chain difficulties efficiently. Expert Group at Financial Investment Bank XYZ: Apple s financial wellness is robustwith a strong balance sheet and consistent cash flow generation. The firm s solutions section has revealed impressive growth, providing a secure revenue stream complementing its equipment sales. Nevertheless, Apple needs to resolve increasing regulatory scrutiny and geopolitical threats, particularly worrying its supply chain dependencies in China, to maintain its competitive edge and long-term productivity. Leads and Risks Leads: Growth in Solutions: Apple s services segment, consisting of Apple&

Songs, Apple TV +, and

iCloud, reveals considerable growth capacity as the firm remains to increase its offerings and customer base. Wearable Innovation: Products like the Apple Watch and AirPods continue to see strong need, contributing to revenue diversification and positioning Apple as a leader in the wearables market. Technology in AR/VR: The newly introduced Vision Pro headset and innovations in enhanced fact(AR)and virtual reality(VIRTUAL REALITY )innovations existing new growth chances

- for Apple, allowing the firm to check out untapped markets and change individual experiences. Threats: Governing Difficulties: Boosting regulatory examination, especially worrying antitrust concerns, data privacy, and individual personal privacy, could impact Apple s operations and strategies, possibly hindering its

- capacity to introduce new products or services. Supply Chain Dependencies: Apple s heavy dependence on making facilities in China and other regions poses dangers connected to geopolitical tensions, trade policies, and supply chain disturbances, which can influence product accessibility and prices. Market Saturation:’In essential markets like smartphones, market saturation and intense competition might restrict growth potential, demanding the exploration of brand-new item categories and cutting-edge services to sustain income development.

- Final thought Element Description Present Share Rate$227.82 (as of July 9, 2025)Market Capitalization$3.2 trillion (since June 2025)Affordable Placing Solid market setting in smartphones, individual computing, and customer electronic devices Development Prospective Development in services, wearables

and AR/VR innovations

Dangers Governing

challenges, supply chain dependences

market saturation For capitalists, Apple s

supply provides both substantial growth potential and risks. Closely checking the elements influencing the

company s efficiency and seeking professional recommendations is suggested prior to making investment choices. FREQUENTLY ASKED QUESTION Q: What is Apple

current supply rate and market capitalization? A: Since July 9, 2025, Apple s

supply

price is$227.82, with a market capitalization of$ 3.2 trillion. Q:

What are the primary development prospects for Apple s supply? A: Secret growth potential customers include development in services, wearable technology, and advancement in augmented truth(AR )and virtual reality(VIRTUAL REALITY )modern technologies. Q: What are the major dangers related to investing in

Apple s stock’? A: Governing difficulties, supply chain reliances, and market saturation in key product classifications are amongst the major dangers investors need to take into consideration.

How to purchase Apple (AAPL) shares